Int. J. Innov. Entrep. 2023, 2(1), 2; doi:10.56502/IJIE2010002

Article

The Evolution of Financial Market Infrastructure: From Digitalization to Tokenization

1

China Development Bank, Beijing 100031, China; antoineguo@qq.com

2

Cardiff Business School, Cardiff University, Cardiff CF10 3EU, UK

*

Corresponding author: zhoup1@cardiff.ac.uk

How to cite: Guo, D.; Zhou, P. The Evolution of Financial Market Infrastructure: From Digitalization to Tokenization. Int. J. Innov. Entrep., 2023, 2(1): 2; doi:10.56502/IJIE2010002.

Received: 15 February 2023 / Accepted: 23 February 2023 / Published: 8 March 2023

Abstract

:This paper examines the historical development and cross-sectional heterogeneities of Financial Market Infrastructure (FMI). From an evolutionary perspective, we review and compare FMIs in the US, Europe, and China. We identify an emerging trend in which the development of FMI is transitioning from digitalization to tokenization with the rise of Distributed Ledger Technology (DLT). Digitalization reinforces centralization, while tokenization promotes decentralization, posing complex challenges to regulatory framework which is also part of FMI. We then specifically analyze DLT-based FMI in the bond market, evaluate different models of tokenization, and propose a heterogeneous consortium blockchain solution.

Keywords:

digitalization; tokenization; blockchain; bond1. Introduction

Financial Market Infrastructure (FMI) refers to the most fundamental back-end systems, processes, and institutions that facilitate the functioning of financial markets, such as the payment and settlement systems, exchanges, and central counterparties (Panagariya, 2022). It provides the foundation for trading, clearing, and settling financial transactions and is critical to the stability and efficiency of the financial system (Berndsen et al., 2018). The evolution of FMI has been shaped by both technological advancements and regulatory changes. Before 2008, FMIs have become more digitalized, centralized, and integrated, leading to increased efficiency, reduced settlement times, and improved risk management. The advent of the internet and advancements in information technology have also enabled new ways of trading and settling financial transactions, such as electronic trading platforms and digital payment systems. However, the global financial crisis of 2008 brought increased attention to the flaws of centralized financial systems and prompted regulatory reforms aimed at improving their stability and resilience (Li and Perez-Saiz, 2018). These reforms, such as the implementation of central clearing for certain types of derivatives and the creation of a new type of central counterparty, have further entrenched the role of FMI.

The rise of distributed ledger technology (DLT), especially blockchain, has provided new opportunities for innovative solutions to FMI, which we term as DLT-FMI. However, these developments have also raised questions about the balance between innovation and regulation, as well as the implications for market structure and the role of intermediaries. Blockchain technology has the potential to disrupt FMI by enabling faster, more secure, and more transparent transactions and settlements (Frizzo-Barker et al., 2020). One of the key benefits of blockchain technology is its decentralized architecture, which eliminates the need for intermediaries and increases transparency and security in financial transactions. For example, blockchain-based payment systems can allow for real-time, cross-border transactions without banks. This can significantly reduce transaction costs and increase the speed of payments (Chang et al., 2020). Another potential use of blockchain technology in finance is the creation of new digital assets, such as cryptocurrencies and non-fungible tokens, which can be used as an alternative to traditional fiat currencies and assets. This can lead to the creation of new financial instruments and markets and can challenge the dominance of traditional financial institutions (Chen et al., 2023). Blockchain technology can also be used to improve the efficiency and reduce the risk of the back-end systems that support financial transactions. For example, blockchain-based settlement systems can enable faster and more secure settlement of trades, reducing the risk of failed trades and increasing overall market efficiency (Kowalski et al., 2021). Nevertheless, the widespread adoption of blockchain in the financial sector will depend on various factors, such as regulatory clarity, security, scalability, and interoperability (Ahluwalia et al., 2020). The financial industry will need to evaluate these challenges carefully to determine the most effective and efficient ways of DLT-FMI. Given the importance of FMI and DLT, this paper aims to bridge the two strands of literature to answer the following research questions (RQs).

- RQ1: How does FMI evolve over time and across countries?

- RQ2: What is the emerging trend of FMI development?

- RQ3: How does DLT contribute to FMI?

- RQ4: What is the optimal mechanism design of DLT-FMI in bond markets?

Section 2 examines FMI from an evolutionary perspective based on the historical development experiences of three major economies (RQ1). The trend from centralized digitalization to decentralized tokenization has been identified as a response to the trust crisis of centralized monetary authorities and financial intermediaries since 2008 (RQ2). Blockchain technology offers a promising solution to mitigate the agency problem and trust issues in traditional centralized FMI. Section 3 then delves into the details of how DLT-FMI can be designed in general (RQ3) and specifically in the context of bond market tokenization (RQ4). We suggest that a gradual, incremental innovation approach should be followed, rather than a disruptive revolution. A balance between decentralization and centralization is necessary to develop DLT-FMI. We propose a solution in the form of a heterogeneous consortium blockchain. Section 4 uses China’s bond market as context to conduct an in-depth case study. Section 5 concludes.

2. An Evolutionary Perspective

According to the Principles for Financial Market Infrastructures (PFMI) published by the Committee on Payment and Settlement Systems (CPSS) and the International Organization of Securities Commissions (IOSCO) in 2012, FMI is defined as “a set of systems, entities, rules, procedures and standards that support the functioning of financial markets by facilitating the exchange of financial assets, including payment and settlement systems, central securities depositories, central counterparties, trade repositories and other similar systems.” PFMI provides a comprehensive framework for the oversight and regulation of FMI, with a focus on ensuring the safety, efficiency, and stability of these critical components of the financial system. The principles cover a wide range of issues, including governance, risk management, and operational efficiency, and provide guidance for regulators to promote market confidence and stability. The aim of PFMI is to promote the safe and efficient functioning of financial markets by ensuring that FMI has robust governance and risk management frameworks in place and by promoting the adoption of common standards and practices across different markets.

To gain a better understanding of the current structure of FMI (RQ1) and predict its future trends (RQ2), it is necessary to extract the patterns from its historical development. In the following subsections, the evolution of FMI in three major economies, the US, Europe, and China, are reviewed.

2.1. US

The evolution of FMI in the US has gone through several significant changes over the past several decades. It can be roughly divided into five historical phases.

- (1)

- Pre-1970s. The FMI in the US was less developed and less sophisticated compared to today’s standards. During this period, financial markets in the US were primarily based on manual systems, with limited use of technology. The discrepancy between the surging demand for transactions in exchanges and the limited capacity of the manual trading system eventually led to the “Paper Blizzard” crisis in 1960s. Overall, the FMI in the US before the 1970s was characterized by limited use of technology, slow and manual processes, and a fragmented structure.

- (2)

- 1970s. The introduction of electronic trading systems in the 1970s marked the beginning of the modern era of FMI in the US. During this period, the first automated trading systems were introduced, and exchanges began to transition from manual open outcry systems to electronic trading platforms.

- (3)

- 1980s-1990s. The 1980s and 1990s saw the growth of over the counter (OTC) financial markets, which added a new layer of complexity to the financial system. The use of OTC derivatives and other complex financial instruments increased during this period, and regulators began to focus on improving the transparency and stability of these markets.

- (4)

- 2000-2008. The 2000s saw significant changes in the regulation of FMIs in the US, as regulators responded to increasing concerns about systemic risk in the financial system. During this period, the Federal Reserve established the Continuous Linked Settlement (CLS) system, which aimed to reduce settlement risk in forex markets.

- (5)

- Post-2008. The 2008 global financial crisis highlighted the importance of strong and effective FMI in ensuring stability and confidence in financial markets. In response to the crisis, regulators in the US and around the world took steps to strengthen FMIs and reduce systemic risk. In the aftermath of the 2008 crisis, the US implemented a number of reforms aimed at improving the stability and resilience of the financial system. These reforms included the Dodd-Frank Wall Street Reform and Consumer Protection Act, which established the Financial Stability Oversight Council (FSOC) to oversee FMIs and promote stability in the financial system. The Total Holding System becomes a centralized solution to clearing bond markets.

Today, the FMI in the US is highly developed and has been shaped by a combination of technological advancements, increased globalization, and regulatory initiatives. It has resulted in a sophisticated and integrated infrastructure that supports the efficient functioning of financial markets and enhances the stability and confidence of the financial system (Zhang and Zhou, 2021). It is featured with mature clearinghouses, payment systems, capital markets, and regulatory framework.

First, The US has a number of clearinghouses, such as the Depository Trust Company, which play a key role in reducing settlement risk and enhancing the efficiency of financial markets. Clearinghouses act as intermediaries between buyers and sellers of securities, and are responsible for maintaining the integrity of the settlement process. Second, The US has several high-speed payment systems, such as the Fedwire Funds Service, which is used for large-value interbank payments, and the Automated Clearing House network, which is used for small-value retail payments. These payment systems aim to improve the efficiency and stability of the payment system in the US. Third, The US has a well-developed capital market infrastructure, with several large stock exchanges, including NYSE and NASDAQ, and a number of other financial markets, such as the bond market and the derivatives market. Fourth, The FMI in the US is subject to a robust regulatory framework, which aims to ensure the stability and efficiency of financial markets. This includes regulations such as the Dodd-Frank Wall Street Reform and Consumer Protection Act, which was implemented in response to the financial crisis of 2008, and the Securities and Exchange Commission (SEC), which is responsible for enforcing securities laws and regulations.

2.2. Europe

The evolution of PMI in Europe has been shaped by a number of key factors, including technological advancements, increased globalization, and regulatory initiatives. Here are some of the key stages of the evolution of FMI in Europe:

- (1)

- Pre-1990s. Before the 1990s, the FMI in Europe was fragmented, with different countries having different systems and processes for clearing and settling financial transactions. There was also limited use of technology in the financial sector, and manual processes were still widely used.

- (2)

- 1990s-2008. During this period, Europe experienced a significant expansion of its financial markets, and there was a growing need for a more integrated and efficient FMI. In response, the EU launched the Single European Payments Area (SEPA) project, which aimed to create a single market for euro payments within the EU.

- (3)

- 2008-2010s. The financial crisis of 2008 had a significant impact on the FMI in Europe and led to increased regulatory scrutiny and a greater focus on stability and resilience in the financial system. This led to the development of the EU’s Capital Markets Union (CMU) initiative, which aims to create a single market for capital in Europe.

- (4)

- 2020s. In recent years, the FMI in Europe has continued to evolve, with a focus on improving the efficiency and stability of financial markets. This has included the development of new technology such as blockchain and increased regulatory oversight, including the implementation of the EU’s MiFID II directive, which aims to enhance the transparency and efficiency of financial markets.

Overall, the evolution of the FMI in Europe has been shaped by a combination of technological advancements, increased globalization, and regulatory initiatives, and has resulted in a sophisticated and integrated infrastructure that supports the efficient functioning of financial markets and enhances the stability and confidence of the financial system. The focus is on improving the efficiency and stability of financial markets by centralized settlement systems, payment systems, capital markets, and regulatory framework.

First, one of the key features of the FMI in Europe is the use of centralized settlement systems, which aim to reduce settlement risk and enhance the efficiency of financial markets. For example, the European Central Securities Depository Regulation (CSDR) requires that all securities transactions in the EU be settled through a central securities depository. Second, The FMI in Europe includes several high-speed payment systems, such as the TARGET2 system, which is used for large-value interbank payments in the EU. These payment systems aim to improve the efficiency and stability of the payment system in Europe. Third, Europe has a well-developed capital market infrastructure, with a number of stock exchanges, including the London Stock Exchange and the Euronext exchange. In addition, the EU has implemented a number of initiatives aimed at enhancing the integration and efficiency of its capital markets, including the CMU project. Finally, The FMI in Europe is subject to a robust regulatory framework, which aims to ensure the stability and efficiency of financial markets. This includes regulations such as the EU Market Abuse Regulation, which aims to prevent market abuse, and the EU MiFID II directive, which aims to enhance the transparency and efficiency of financial markets.

2.3. China

The FMI in China has undergone significant development and evolution since late 1970s, as the country has transformed into one of the world’s largest economies.

- (1)

- 1970s-1980s. During this period, the Chinese government started to reform the country’s financial system and opened up the economy to foreign investment. This helped to lay the foundation for the development of the FMI in China and paved the way for the growth of the stock market and other financial markets in the years to come.

- (2)

- 1990s. China established its first stock market, the Shanghai Stock Exchange, in 1990, and later established the Shenzhen Stock Exchange. These stock exchanges have grown rapidly in size and importance, and now rank among the largest in the world.

- (3)

- 2000s. The first decade of the 21st century saw continued growth and development of the FMI in China, as the country became an increasingly important player in the global financial system. The Chinese stock market continued to grow. The banking sector underwent significant reforms, but many shadow banking activities were developed as the transition took place (Wang et al., 2021). New payment systems were developed to support the growth of electronic commerce.

- (4)

- 2010s. During this decade, the FMI in China experienced rapid expansion and growth, as the government continued to support the development of key financial institutions and infrastructure. The bond market grew rapidly, becoming one of the largest in the world and providing an important source of financing for the government and for corporations. Additionally, the regulatory framework for the FMI in China was strengthened, helping to reduce systemic risk and improve market efficiency.

- (5)

- 2020s. In recent years, the FMI in China has continued to evolve and mature, as the government has implemented new reforms and initiatives to support the growth of the financial markets. This has included measures to promote green bonds (Guo and Zhou, 2021a), increase market transparency, reduce systemic risk, as well as efforts to encourage the use of new technologies, such as blockchain. Specifically, PBOC developed and launched the first central bank digital currency e-CNY in 2020. In the meantime, blockchain technology is also applied to solving traditional finance problems such as cross-border payments, supply chain finance, and bond issuance (tokenization).

Overall, the evolution of the FMI in China has been shaped by a combination of government support, market forces, and technological advancements, and has helped to position the country as a key player in the regional trade and global financial system (Guo and Zhou, 2021b). The FMI of China has developed its own characteristics in the following building blocks.

First, China has two major stock exchanges, the Shanghai Stock Exchange and the Shenzhen Stock Exchange, which rank among the largest in the world by market capitalization. The Chinese stock markets provide a venue for companies to raise capital and for investors to trade and invest in stocks. Second, the banking sector in China is dominated by a few large state-owned banks, but also includes a growing number of smaller private banks and other financial institutions. The banking sector has undergone significant reforms and consolidation in recent years, improving the stability and efficiency of the sector. Third, China has a number of modern and efficient payment systems, including the China National Advanced Payment System, which allows for real-time interbank transfers and helps to improve the efficiency of the payment system in the country. Fourth, China has a large and rapidly growing bond market, which provides an important source of financing for the government and for corporations. The bond market has been supported by the development of key institutions and infrastructure. Finally, the regulatory framework for the FMI in China is overseen by the People’s Bank of China (PBOC), the country’s central bank, which has been instrumental in guiding the development of the FMI in recent years. The PBOC has been focused on improving market efficiency, reducing systemic risk, and protecting the interests of investors.

2.4. Trend Analysis

Based on the evolutionary paths of US, Europe, and China, we summarize the following dimensions of modern FMI: stock market, bond market, banking system, payment system, and regulatory framework. Each of these FMI components plays a crucial role in maintaining the stability and efficiency of financial markets, and they work together to facilitate the smooth functioning of financial markets.

Table 1 compares the FMIs of the US, Europe, and China. It shows that the US has been at the forefront of FMI development, with a mature and comprehensive financial foundation. The US was the first economy to digitalize its FMI, and after the financial crisis of 2008, the focus shifted to regulation. Europe followed in the US’s footsteps in terms of digitalization and regulation, but with a unique emphasis on integration among different members of the region. The issuance of the Euro currency helped unify the monetary system, but also led to debt issues. The current focus in Europe is on regulation and the adoption of new technologies. China lagged behind until the 1990s but has since seen the fastest development due to its ability to adopt and adapt to existing models. The transition costs for adopting new technology in China are lower, and the country has been at the forefront of blockchain technology adoption, as it benefits the most from the decentralization feature of the technology. Conversely, the US, as the established center, is more cautious about blockchain technology, as the essence of decentralization is to challenge the market power of the center.

Table 1.

Comparison of FMIs of US, Europe, and China.

| US | Europe | China | |

|---|---|---|---|

| Pre-1970s | manual exchanges (open cry and paper based); intermediaries (broker-dealer); fragmented payment systems | fragmented, mainly manual (paper based) | no exchange; command economy without financial markets; cash-based and stamp-based payment system |

| 1970s | electronic trading system introduced | ||

| 1980s | OTC introduced | reform and open-up | |

| 1990s | financial derivatives developed, regulation developed to ensure transparency and stability | digitalized system introduced to improve efficiency | stock exchanges established |

| 2000-2008 | regulation developed to reduce settlement risk in forex market (e.g., CLS) | Integrated monetary, banking, and payment system (e.g., SEPA, Euro) | banking sector reformed to be market-based, digitalized system introduced |

| 2008-2010s | regulation developed to reduce systemic risk (e.g., FSOC), Total Holding System in bond market | regulation developed to improve stability and resilience (e.g., CMU) | bond market developed for both companies and governments, digital payment system |

| 2020s | regulation developed for blockchain-based finance (e.g., SEC) | new technology adoption such as blockchain (e.g., MiFID II) | blockchain, e-CNY, regulation developed to reduce systemic risk, Transparent Holding System (THS) in bond market |

The comparison of FMIs of the three major economies has revealed three key trends in the development of FMI. First, digitalization has been accelerating, leading to streamlining of processes, improved efficiency, increased transparency, cost savings, and reduced risk. This trend started in the US since 1970s and has spread to all fields of FMI such as the stock market, bond market, banking, and payment systems. The result of digitalization is a highly centralized system, which is subject to the principal-agent problem eventually leading to the global financial crisis in 2008. Second, tokenization has emerged as a new form of FMI, where traditional financial assets are converted into digital assets, often referred to as tokens. Tokenization has the potential to revolutionize the way financial assets are traded and settled, offering increased efficiency and accessibility, as well as transparency and decentralization through blockchain solutions. Finally, regulation has been evolving in tandem with the development of new technologies like big data, AI, and blockchain, becoming increasingly important to ensure an orderly financial market. Regulations set the rules within which market participants can play and need to evolve with the new challenges posed by the development of these technologies.

3. DLT as FMI

Blockchain technology is the most famous DLT thanks to the hype of blockchain-based cryptocurrencies like Bitcoin and Ethereum. As argued earlier, the incorporation of DLT into FMI or DLT-FMI provides an innovative solution to payment and settlement. This section introduces the technical framework of DLT and its novel features as FMI (RQ3) and analyzes the practicality of DLT-FMI in bond market (RQ4).

3.1. Technical Framework

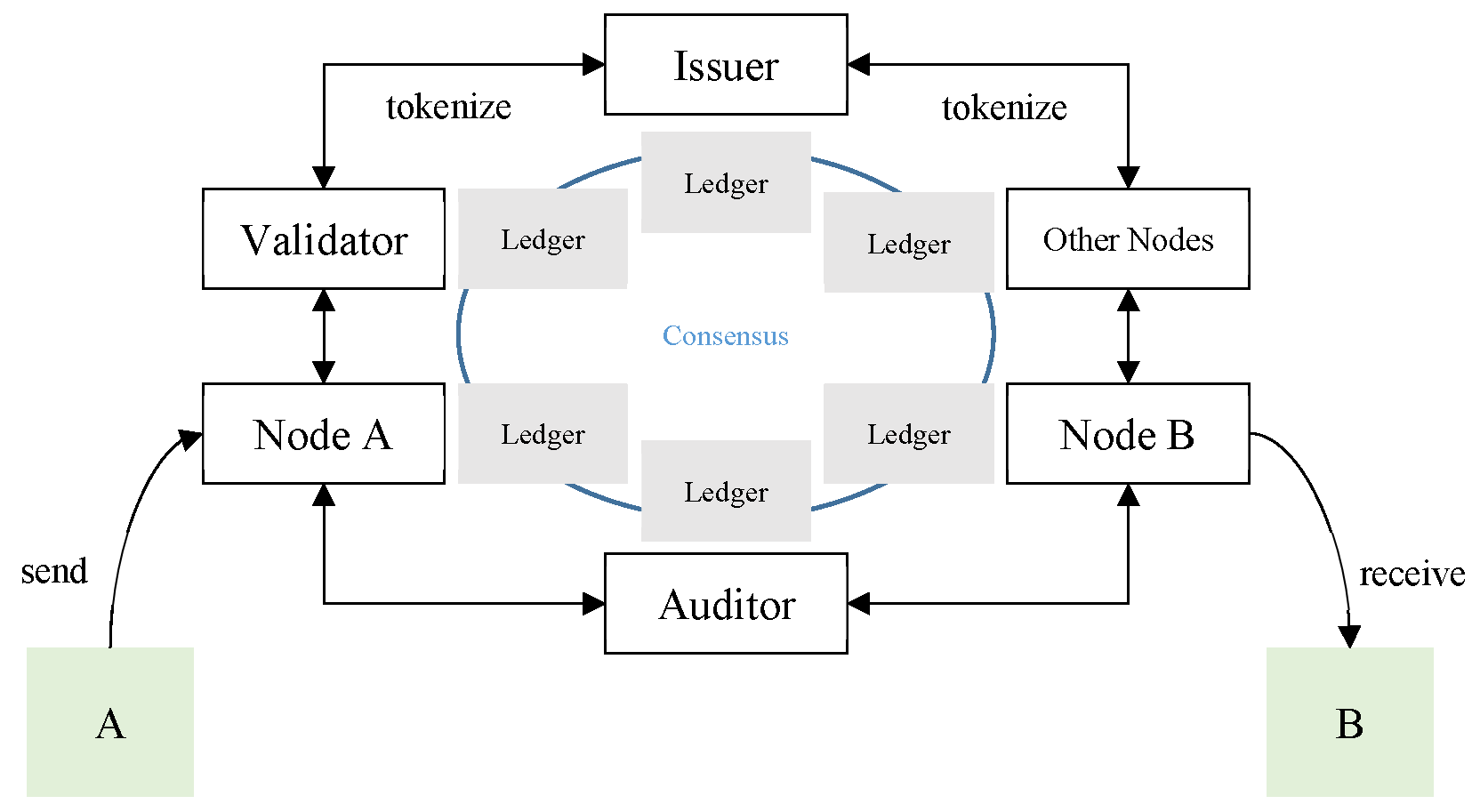

As illustrated in Figure 1, the issuer of assets (e.g., bond) tokenizes its assets into tokens and sell it to the public. Ownership is recorded in distributed ledgers verified by validators using a certain consensus mechanism such as proof of stake. After the issuance, transactions between two parties A and B can be done without a trusted third party. A sends its tokenized assets to the blockchain via its own node, which is received by the node of B. This transaction is broadcast to the entire blockchain, where validators verify the transaction and encapsulate the data into the new block. In some blockchains, auditors exist to review the accuracy and integrity of transaction records, verify the authenticity of smart contracts, and ensure the security of blockchain networks. The defining feature of DLT is decentralization structure, which enhances the trust among market participants without a trusted authority or intermediary.

There are many ways that DLT (blockchain in particular) can be used as an FMI. First, it improves transparency. Blockchain’s decentralized and transparent ledger can provide a clear and reliable record of transactions and ownership, which can improve the transparency of the financial market and increase trust among market participants. Second, it reduces settlement risk. Blockchain’s real-time transaction processing and automatic reconciliation features can reduce the time required to settle trades, which can help to reduce settlement risk and improve market efficiency. Third, it enhances security. Blockchain’s decentralized and secure nature can help to reduce the risk of cyberattacks and fraud, which are major concerns in the financial market. Fourth, it increases interoperability. Blockchain’s interoperable nature can help to connect different financial market infrastructures and reduce the barriers to entry in the financial market, which can increase competition and promote innovation. Finally, it tokenizes assets. Blockchain’s ability to tokenize assets, such as bonds and securities, can provide a new and more efficient way to manage and trade these assets, which can increase market liquidity and reduce the costs of trading.

Figure 1.

The technical framework of DLT.

To make use of these features, the integration of DLT to existing FMI can be either partial or complete. We can unify consensus mechanism, cryptographic algorithm, and smart contracts into one integral piece, resulting in a complete DLT-FMI solution. Alternatively, partial integration models can serve ad hoc contexts such as central securities depository (CSD) and payment systems (PS), leading to DLT-CSD and DLT-PS. Therefore, the decision of blockchain adoption is not only a matter of yes or no (extensive margin), but also a matter of degree (intensive margin).

Table 2 examines the differences in permission of access, operation, restrictions on participation, role of nodes, and consensus mechanisms in DLT-FMI. At one end, Plan A is a traditional centralized FMI, and at the other end, Plan D is a pure public blockchain. The former has a proven history of high agency costs, while the latter inevitably leads to high regulatory risks. The eclectic Plans B and C are more likely to be implemented in practice because they strike a good balance between innovation and regulation. In other words, an incremental innovation is preferred to disruptive innovation.

Table 2.

Different types of DLT-FMI.

| Plan A | Plan B | Plan C | Plan D | |

|---|---|---|---|---|

| Permission | Permissioned | Permissioned | Permissioned | Permissionless |

| Operation | Centralized | Decentralized | Decentralized | Decentralized |

| Restriction | Restricted | Restricted | Restricted | Unrestricted |

| Node’s role | Heterogenous | Heterogenous | Homogenous | Homogenous |

| Consensus | Single | Single/Multiple | Multiple | Multiple |

3.2. Bond Market

This subsection focuses on the risks of DLT-FMI in a particular context, bond market, which plays a critical role in FMI. It provides a platform for issuers to raise capital and for investors to access a diverse range of fixed income investments. Bond market is also likely to be the first financial market to adopt tokenization (bond tokenization) to promote efficiency, transparency, security, and accessibility.

- Technical risk. The implementation of DLT-based FMI in bond markets is still a relatively new concept, and there are concerns about the stability, security, and scalability of the technology. There is also a risk of system failures and technical glitches that can disrupt the functioning of the bond market.

- Regulatory risk. DLT-FMI operates in a decentralized manner, which raises concerns about the lack of central control and oversight. This can result in difficulties for regulators in monitoring and enforcing regulations, leading to regulatory risks.

- Market risk. The use of DLT in the bond market may also result in new types of market risks, such as liquidity risks, as well as increased risks related to the transfer and custody of securities.

- Operational risk. The implementation of DLT-based FMI in the bond market requires significant changes to existing systems and processes, and there is a risk of operational disruptions and inefficiencies during the transition.

- Legal risk. The use of DLT in the bond market may raise legal and contractual issues related to the ownership and transfer of securities, which can result in disputes and legal challenges.

Overall, the incorporation of DLT-FMI in the bond market presents a number of risks that must be carefully considered and managed in order to ensure its success. The key to overcoming these risks is to strike a balance between the benefits offered by DLT and the need for stability, security, and regulatory compliance in the financial market.

To address the specific risks in the bond market, a gradual or “incremental innovation” approach is suggested for blockchain adoption. Digital bonds can be defined in two forms using an evolutionary perspective from digitalization to tokenization. One is “tokenized bonds”, which are issued, registered, managed, and transacted on blockchains throughout the entire lifecycle of bonds. The other is “bond tokenization”, which aims to use on-chain counterparts to represent off-chain bonds (partly or entirely). It facilitates rather than replaces traditional issuance, registration, management, and transaction of bonds. Rather than jumping into issuing pure tokenized bonds (Plan D), the emphasis should initially be on tokenizing existing bonds (bond tokenization). This creates a new form of existing assets rather than new assets, as the market needs time to build trust in the disruptive technology and regulations need time to mature. Hence, the transition from digitalization to tokenization should begin with the traditional financial and regulatory framework, augmented with the benefits of DLT-FMI.

Furthermore, it is recommended that consortium blockchains (Plans B and C) should be utilized instead of public blockchains (Plan D) for the incremental innovation of bond tokenization. A key characteristic of consortium blockchains is their diverse nodes. Allocating varying powers and responsibilities to different nodes strikes a balance between decentralization and centralization benefits. Unlike a homogenous mechanism (Plan C), a consortium blockchain with heterogeneous nodes (Plan B) can reduce the risks of financial instability and the “51% attack”.

4. Case Study: Bond Market in China

The size of China’s bond market is one of the largest in the world and the FMI development in China is at the forefront of major economies. This section uses China’s bond market as a case study to draw some policy implications on DLT-FMI. On the one hand, a “disruptive innovation” on existing FMI is not suitable in the Chinese context. The FMI of China’s bond market has a fast follower’s advantage. China’s bond market plays a leading role in developing a Transparency Holding System (THS), which is a more reliable design compared to the US’s Indirect Holding System (IHS) and disruptive DLT-FMI. On the other hand, an “incremental innovation” of FMI incorporating selected benefits of DLT is more appropriate. In fields like cross-market bond settlements and cross-border bond issuance, blockchain technology can play an important role, but the incorporation should be gradual. The two policy implications are analyzed in the following subsections.

4.1. Why Not Disruptive Innovation

DLT-FMI is regarded as a disruptive solution to the traditional indirect holding system of bonds. For example, the IHS in the US assign the bond ownership to intermediaries at the cost of investor’s legal ownership. Moreover, the investors undertake the credit risks of intermediaries, especially when intermediaries run into bankruptcy. In this case, legislations generally do not prioritize the investors’ claims of their own bonds. In addition, intermediaries can misuse the bonds held by them. These drawbacks of IHS are resolved by the THS adopted by countries like China, Greece, and Scandinavian countries. In the THS, intermediaries hold rather than own bonds for the investors. In other words, the trust issues are already solved by THS without resorting to DLT-FMI solutions.

In terms of financial regulations, CNY-denominated bond markets have a significant fast follower’s advantage in developing its FMI. The THS provides a transparent mechanism for regulation as well as an efficient solution for transactions, which are supposed to be the benefits of DLT-FMI. For example, the inter-bank bond market in China adopted a centralized and digitalized processing system, which can achieve a T+0 settlement since 2004. This efficiency is significantly higher than the counterpart in the US. The US model (IHS) is essentially a multi-level custodian system, which forms a pyramid structure. The efficiency of the system depends on the level with the lowest efficiency, and the security of the system also depends on the level with the lowest security. In 1995, the SEC revised the legislation to reduce the settlement duration from T+5 down to T+3. Only in 2017 has the settlement duration reduced to T+2, which is still significantly longer than the THS in China.

Therefore, the existing FMI in China’s bond markets (especially the inter-bank bond market) have already achieved the desired efficiency in operation and transparency in regulation. The centralized FMI also has a mature legal framework and FinTech toolbox, which are superior to the immature, unstable DLT-FMI solutions.

4.2. Why Incremental Innovation

China’s bond market is large, but it is still in its infancy stage of an emerging economy. Internationalization of CNY and marketization of CNY-denominated bonds have encouraged foreign holdings of Chinese government bonds. It is an embodiment of the strong confidence of the world in the Chinese economy, but international hot money also inflicts a security threat to the government bond market. Since the COVID-19, the global economy has been flooded with excessive liquidity due to QE and low interest rates. Unconventional monetary policies impose unbalanced threat and risks to emerging economies, because they lack flexibility in the capital market. To avoid such crises, bond market in China needs to take an incremental innovation to gradually incorporate DLT into the existing FMI.

4.2.1. Heterogeneous Consortium Blockchain

The DLT-FMI in the bond market should start with a heterogenous consortium blockchain. In the status quo, there are two bond markets in China: one is inter-bank bond market, and the other is open exchange market. The two-tier bond market structure is entrenched by three back-end institutions: China Securities Depository and Clearing Corporation (CSDC), China Central Depository & Clearing Company (CCDC), and Shanghai Clearinghouse (SHCH). Among the three organizations, only CSDC and CCDC have developed a collaboration mechanism which only focus on custodian and exchange of selected government bonds. Most bonds are not tradable in different locations.

Specifically, CCDC has been leading the digitalization strategy of China. A national blockchain-based FMI pilot project has been successfully launched in 2022, and the first industrial standard and connection regulation of blockchain-based bond issuance will be published in 2023. Other breakthroughs in FMI include digitalization of bond market disclosure using the Extendable Business Reporting Language (XBRL), maturity structure management of local government bonds using automated models, and reduction of financing cost. CCDC follows five philosophies in their development of FMI, i.e., innovation, coordination, green, open, and sharing.

To address double bookkeeping issues due to the lack of direct information sharing among exchanges, an obvious solution is to develop a centralized FMI. According to the historical experience in the US, a central custodian trustee is established to bridge the other local exchanges. In 1980s, there were seven custodian trustees, but now they have been merged into one centralized custodian—Depository Trust & Clearing Corporation (DTC). There are about 40 electronic bond exchanges in the US, all of which have direct connection with DTC to enable an easier access to the bond market. Another example is the EU, where cross-border bond markets are directly connected with a centralized trustee in each country. For example, client platforms like MTS, Tradeweb, Bloomberg, and Euroex Bond are directly linked with the central trustee in German, making it convenient to engage in international investment on cross-border bond markets.

In China’s context, it is difficult to directly adopt the international experience without adaption. To enhance the connectivity of existing FMI without a disruptive innovation, a heterogeneous consortium blockchain strikes a good balance between regulation and innovation. The basic idea is to maintain procedures and frameworks of existing FMI, but it is augmented with and connected by a cross-market blockchain. CSDC and CCDC are major market participants with heterogeneous responsibilities and powers. They can validate transactions and form new blocks in the chain. This eclectic approach is an example the Plan B in Table 2, which is an incremental innovation of DLT-FMI.

4.2.2. Regulation Framework

It is essential to protect the financial stability by online and offline monitoring of national and international fund flows. The regulation framework must be adjusted to supervise the heterogenous consortium blockchain in the following three aspects.

The first is to make regulators as key market participants on the blockchain. Consortium blockchain is featured with permissioned access to mitigate risks of permissionless, unregulated public blockchains. The ledgers on the consortium blockchain are validated by key market participants (e.g., CSDC and CCDC) rather than any participants. The differences in market power and responsibilities make it a heterogenous consortium blockchain. In this way, regulatory bodies such as PBOC can also act as key market participants to authorize transaction. It therefore combines the benefits of DLT-FMI with the need of regulation.

Second, regulations must be adapted to accommodate foreign market participants. The onshore bond markets in China are bound to link with FMIs in other countries to enable international investment, but the connection must be selective and prudential. If foreign institutes are admitted to the consortium blockchain, the regulation framework and market rules should be based on the paradigm in China (e.g., THS). This is to avoid malicious attacks and to maintain the financial stability. Nevertheless, non-essential elements should be flexible to promote the merges between domestic and international standards and rules. The goal is to build a global FMI with the help of DLT without sacrificing financial stability and security.

Finally, regulations should be adapted to join foreign DLT-FMI to issue new tokenized bonds in offshore bond markets. At present, the World Bank and central banks in many countries (e.g., Australia and Singapore) have developed blockchains for issuing tokenized bonds. To make full use of the global financial market, China should actively join foreign DLT-FMI and revise regulations accordingly. It is unlikely for China to issue tokenized bonds in offshore blockchains in the short run, but participation in foreign DLT-FMI can accumulate relevant knowledge based on international experience.

4.2.3. Bond Tokenization

According to the incremental innovation, it is suggested to start the DLT-FMI with tokenization of existing bonds under the current regulation framework (“bond tokenization”), rather than directly issuing new “tokenized bonds”. In other words, tokenization should serve the existing bond market in information sharing and trust building, rather than generate new forms of digital assets. In this way, existing legal and regulatory frameworks are still working, so bond tokenization will not disrupt the bond market.

Technically, a heterogeneous consortium blockchain should have the following mechanisms. First, the consensus mechanism should differentiate between fundamental (e.g., voting rights) and transactional validation. Second, an arbitration mechanism should be implemented. The arbitration can either be resolved through decentralized on-chain votes or through a centralized court. Third, a communication mechanism should be implemented. Regular Q&A sessions should be held to ensure transparency and the platform’s flexibility to adapt to changing market needs. This feature also calls for certain degree of centralization to provide incentive of platform administration.

5. Conclusions

This paper reviews the historical evolution of FMI in three major economies (RQ1) and identifies an emerging trend of transitioning from digitalization to tokenization (RQ2). Starting in the 1970s, digitalization has reinforced the centralized power of traditional financial intermediaries. However, the 2008 global financial crisis resulted in a trust crisis for centralized institutions.

To address the principal-agent problem of centralized systems, DLT, particularly blockchain technology, provides a solution to restore trust among market participants by removing the need for a trusted authority or intermediary (RQ3). This trend towards decentralization has resulted in many new forms of FMI based on DLT, which we refer to as DLT-FMI.

Our evidence-based findings on FMI are relevant to policymakers and decision-makers in the financial industry, especially for transition economies like China. Financial stability is crucial for economic reform and development, so a disruptive revolution of DLT-FMI can bring unpredictable turbulences to the financial market and the entire macroeconomy. We analyze the application of blockchain in the bond market and conclude that an incremental innovation with both decentralized and centralized features is more appropriate for blockchain adoption (RQ4). We then propose a heterogeneous consortium blockchain solution to DLT-FMI and suggest that tokenization should start with existing bonds (bond tokenization) to minimize regulatory uncertainties, rather than introducing brand new assets (tokenized bonds).

Author Contributions

Conceptualization: D.G. and P.Z.; Data curation: D.G. and P.Z.; Formal analysis: D.G. and P.Z.; Funding acquisition: D.G. and P.Z.; Investigation: D.G. and P.Z.; Methodology: D.G. and P.Z.; Project administration: D.G. and P.Z.; Resources: D.G. and P.Z.; Software: D.G. and P.Z.; Supervision: D.G. and P.Z.; Validation: D.G. and P.Z.; Visualization: D.G. and P.Z.; Writing—original draft: D.G., P.Z.; Writing—review & editing: D.G. and P.Z. All authors have read and agreed to the published version of the manuscript.

Funding

This research was funded by The National Social Science Fund of China, grant number 21BGJ074.

Acknowledgments

The authors thank the anonymous reviewers for their constructive comments.

Conflicts of Interest

The authors declare no conflict of interest.

References

- Ahluwalia, Saurabh; Raj V., Mahto; Guerrero, Maribel. Blockchain technology and startup financing: A transaction cost economics perspective. Technological Forecasting and Social Change 2020, 151, 119854. [Google Scholar] [CrossRef]

- Berndsen, Ron J.; Carlos, León; Renneboog, Luc. Financial stability in networks of financial institutions and market infrastructures. Journal of Financial Stability 2018, 35, 120–135. [Google Scholar] [CrossRef]

- Chang, Victor; Patricia, Baudier; Zhang, Hui; Xu, Qianwen; Zhang, JingQi; Arami, Mitra. How Blockchain can impact financial services – The overview, challenges and recommendations from expert interviewees. Technological Forecasting and Social Change 2020, 158, 120166. [Google Scholar] [CrossRef] [PubMed]

- Chen, Renee Rui; Chen, Kun; Ou, Carol X.J. Facilitating interorganizational trust in strategic alliances by leveraging blockchain-based systems: Case studies of two eastern banks. International Journal of Information Management 2023, 68, 102521. [Google Scholar] [CrossRef]

- Frizzo-Barker, Julie; Chow-White, Peter A.; Adams, Philippa R.; Mentanko, Jennifer; Ha, Dung; Green, Sandy. Blockchain as a disruptive technology for business: A systematic review. International Journal of Information Management 2020, 51, 102029. [Google Scholar] [CrossRef]

- Guo, Dong; Zhou, Peng. Green bonds as hedging assets before and after COVID: A comparative study between the US and China. Energy Economics 2021a, 104, 105696. [Google Scholar] [CrossRef]

- Guo, Dong; Zhou, Peng. The rise of a new anchor currency in RCEP? A tale of three currencies. Economic Modelling 2021b, 104, 105647. [Google Scholar] [CrossRef]

- Kowalski, Michał; Lee, Zach W.Y.; Chan, Tommy K.H. Blockchain technology and trust relationships in trade finance. Technological Forecasting and Social Change 2021, 166, 120641. [Google Scholar] [CrossRef]

- Li, Fuchun; Perez-Saiz, Hector. Measuring systemic risk across financial market infrastructures. Journal of Financial Stability 2018, 34, 1–11. [Google Scholar] [CrossRef]

- Panagariya, Arvind. Digital revolution, financial infrastructure and entrepreneurship: The case of India. Asia and the Global Economy 2022, 2, 100027. [Google Scholar] [CrossRef]

- Wang, Chaowei; Le, Vo Phuong Mai; Matthews, Kent; Zhou, Peng. Shadow banking activity and entrusted loans in a DSGE model of China. The Manchester School 2021, 89, 445–469. [Google Scholar] [CrossRef]

- Zhang, Bo; Zhou, Peng. Financial development and economic growth in a microfounded small open economy model. The North American Journal of Economics and Finance 2021, 58, 101544. [Google Scholar] [CrossRef]

© 2023 Copyright by Authors. Licensed as an open access article using a CC BY 4.0 license.